- blog

- Statistics

- Black Friday Statistics 2025: $10.8B Sales & New Data

Black Friday Shopping Statistics 2025: Complete Guide with Latest Data

Table of Contents

Black Friday 2024 just smashed every record in the book. We’re talking $10.8 billion in US online sales alone – that’s a massive 10.2% jump from last year. And here’s the kicker: 69% of all purchases happened on mobile devices while people were probably still digesting their Thanksgiving turkey.

If you’re a business owner trying to make sense of this shopping frenzy, you’ve come to the right place. These aren’t just random numbers – they’re insights that can transform how you approach the biggest shopping holiday of the year. Whether you’re planning your 2025 strategy or just curious about where retail is heading, this data tells a story about changing consumer behavior, technology adoption, and serious money movement.

Let’s dive into the numbers that matter and what they mean for your business.

Top Black Friday Statistics 2025 (New Data)

The latest Black Friday statistics paint a picture of unprecedented digital dominance and consumer enthusiasm. Here are the standout numbers that every business owner should know:

Record-Breaking Online Sales: US consumers spent $10.8 billion online during Black Friday 2024, marking a 10.2% increase from 2023’s $9.8 billion. To put this in perspective, that’s $1 billion more than last year – in just one day.

Global Shopping Surge: Worldwide, Black Friday generated $74.4 billion in online spending, up 5% from the previous year. This massive sales figure shows Black Friday’s truly global reach beyond just US borders.

Mobile Takes Over: Mobile devices dominated with 69% of all Black Friday purchases globally, slightly up from 68% in 2023. For US markets specifically, mobile sales accounted for 55% of all online transactions.

BNPL Continues Rising: “Buy Now, Pay Later” services contributed $686.3 million to US online sales, showing an 8.8% increase year-over-year. This payment method is becoming a serious revenue driver.

AI Drives Traffic: Retail websites experienced a staggering 1,800% increase in traffic originating from AI tools like ChatGPT, signaling a major shift in how people discover deals.

Shopping Behavior Split: 87.3 million Americans shopped online while 81.7 million visited physical stores on Black Friday. Interestingly, this represents the highest in-store turnout since the pandemic.

💡 Ready to reach Black Friday shoppers? Get verified email addresses instantly

[Find Emails →]

The trend is crystal clear: digital channels are winning, but smart retailers are finding ways to blend online convenience with in-store experiences. The businesses crushing it in 2025 will be those that master this balance.

Black Friday Sales 2024 — Latest Reports

Let’s break down exactly how different players performed during the biggest shopping day of the year. These sales figures reveal which strategies worked and where the money flowed.

Major Retailer Performance: Target’s Black Friday sales reached over $500 million, representing a significant increase from last year, while Walmart’s Black Friday sales surpassed $1.77 billion. These numbers show that even traditional retailers are benefiting from the digital surge.

Platform Success Stories: Shopify merchants alone processed $4.1 billion in sales on Black Friday 2024, a remarkable 22% increase from their 2023 figures. This demonstrates the growing power of independent e-commerce businesses.

Cyber Week Dominance: The shopping didn’t stop on Friday. Thanksgiving kicked things off with $6.1 billion in online spending (up 8.9%), followed by Black Friday’s $10.8 billion, and Cyber Monday’s record-breaking $13.3 billion.

Peak Shopping Intensity: Between 10 a.m. and 2 p.m. on Black Friday, online shoppers were spending an average of $11.3 million per minute. That’s the kind of sales velocity that can make or break a business.

Category Winners: Adobe reports that makeup and skincare, smartwatches, and Harry Potter- and Wicked-themed items were the hottest buys on Black Friday 2024. Meanwhile, toys and games led the overall sales boost, closely followed by apparel and accessories.

Discount Effectiveness: The average discount rate was 28% according to Salesforce, with specific categories showing impressive markdowns: toys (down 27.8%), electronics (down 27.4%), TVs (down 24.2%), and apparel (down 22.2%).

Traffic vs. Conversion Reality: While roughly 72% of holiday shoppers, or 131.7 million consumers, planned to shop on Black Friday, the actual conversion rates varied significantly between channels and devices.

The data shows a clear pattern: businesses that invested in mobile optimization, offered flexible payment options, and started promotions early captured the biggest share of this massive sales figure.

Black Friday Sales Worldwide (Latest Data)

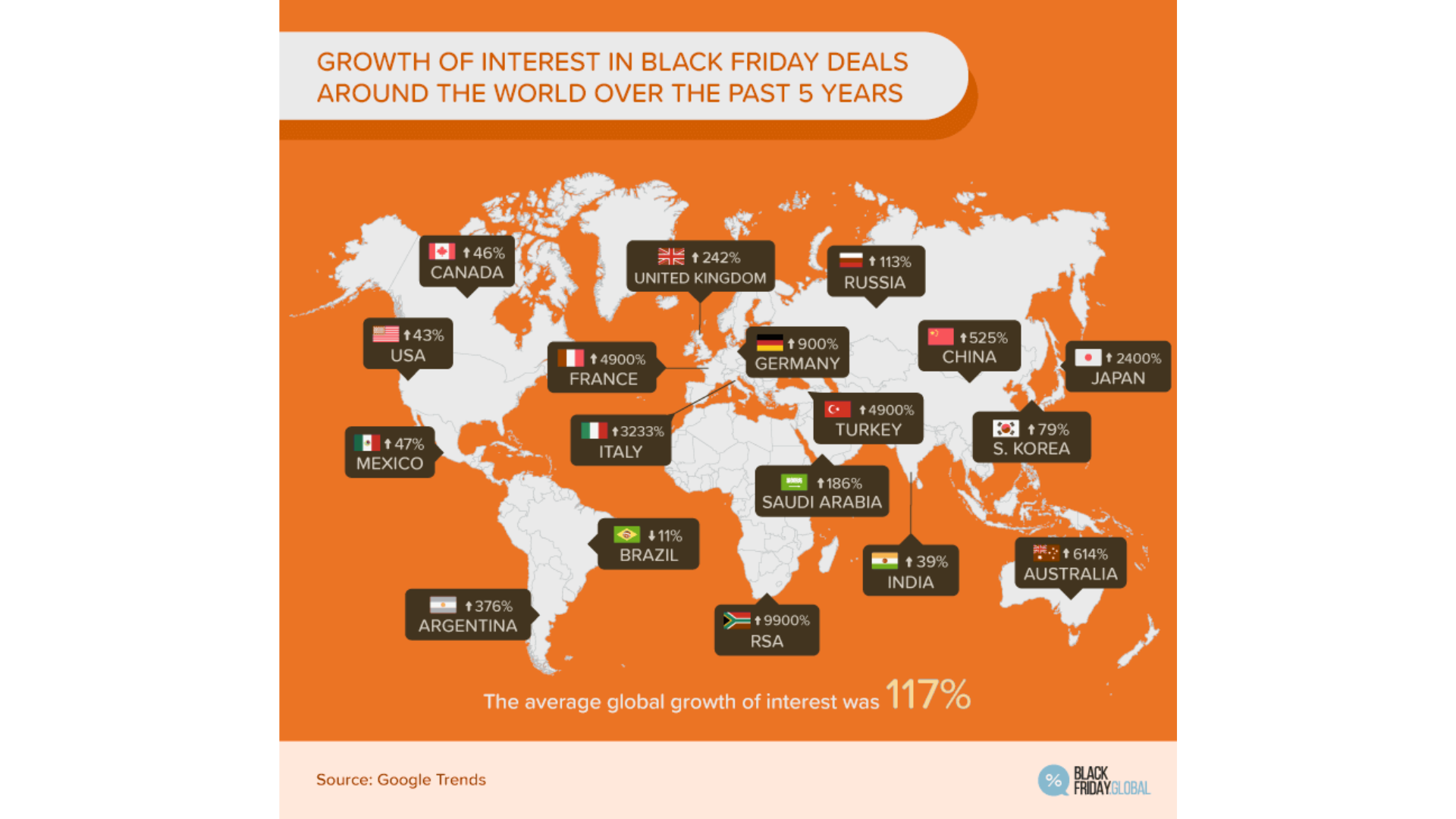

Black Friday isn’t just an American phenomenon anymore – it’s a global shopping holiday that’s reshaping retail worldwide. Here’s how different regions performed and what it means for international business.

European Performance: Western Europe saw online sales during Black Friday week surge dramatically, increasing by +122% to +125% compared to an average week. The region showed strong digital engagement with 46% of online shoppers making at least one purchase during the event.

Price-Driven European Shoppers: Consumer behavior in Western Europe was heavily influenced by price, with 74.9% of shoppers prioritizing it as the most critical purchasing factor. This price sensitivity is creating opportunities for businesses that can offer genuine value.

Platform Innovation: New players like TikTok Shop achieved notable penetration, reaching 13% market presence in the UK. This shows how quickly new platforms can gain traction during peak shopping periods.

Canadian Market Growth: In Canada, Black Friday reclaimed its title as the busiest shopping day of 2024, with transaction volume increasing by +11% year-over-year and average transaction size growing by 7%.

Emerging Market Potential: Brazil’s Black Friday 2024 projections anticipated revenue of R$205.11 billion, representing approximately 10% growth compared to 2023. These emerging markets represent huge untapped opportunities.

Global Shopping Behavior: Online Black Friday sales saw a +158% increase in unit sales compared to an average week, whereas physical stores experienced a more modest +63% increase. The digital preference is consistent worldwide.

Scale Your Outreach

Connect with millions of Black Friday shoppers

[Start Free →]

Technology Adoption Varies: Different regions are adopting shopping technologies at varying rates. While mobile dominates globally, payment preferences, delivery expectations, and platform choices show significant regional variation.

The global expansion of Black Friday creates opportunities for businesses willing to adapt their strategies to local preferences while leveraging universal trends like mobile commerce and price sensitivity.

Black Friday Discount Statistics

Understanding discount psychology and effectiveness is crucial for business owners planning their pricing strategies. Here’s what the data reveals about what actually drives purchases.

Average Discount Ranges: Black Friday 2024 saw average discounts ranging from 11% to 23% across various product categories, with some analyses suggesting an average discount hovering around 25%. However, data from 2023 indicated an average Black Friday discount of approximately 31%.

Category-Specific Discounts: The deepest discounts appeared in specific categories. Global discount rates during the holiday period included Makeup (36-40%), General Apparel (30-34%), and Skincare (28-33%). These categories consistently offer the most aggressive pricing.

Physical Store Traffic Drivers: Retailers that slashed prices by at least 40% to 50% were more successful in attracting shoppers to their brick-and-mortar locations. Deep discounts remain the primary motivator for in-person shopping.

Consumer Trust Issues: Here’s something concerning for retailers: while 50% of shoppers completely or mostly trust retailers’ Black Friday offers, a notable 16% rarely or do not trust them at all. This trust deficit creates opportunities for transparent, honest retailers.

Discount Effectiveness: Click-through rates increase by 35% during Black Friday, indicating high engagement levels, while conversion rates also increase considerably. The data shows that well-positioned discounts don’t just attract attention – they drive actual sales.

Strategic Timing: Metrics show that early promotions attract more attention and interaction than last-minute ones. Business owners who start their campaigns early often see better engagement rates.

The discount data reveals a clear truth: it’s not just about offering the lowest price. Successful retailers focus on perceived value, trustworthy communication, and strategic timing to maximize their discount effectiveness.

Holiday Shopping Statistics

Black Friday is just the kickoff to a massive holiday shopping season that generates hundreds of billions in revenue. Here’s how the entire period performed and what business owners need to know.

Total Season Performance: The entire 2024 holiday season (November 1 through December 31) saw core US retail sales grow by 4% over 2023, reaching a record $994.1 billion. That’s nearly $1 trillion in total spending.

Online Dominance: Online sales were a significant driver, with spending up 8.6% year-over-year to $296.7 billion for the holiday period. Digital channels now represent a massive chunk of total holiday revenue.

Mobile Commerce Explosion: Mobile orders accounted for nearly 70% of all orders during the holiday season, initiating $195 billion in US sales and $842 billion globally. If your business isn’t mobile-optimized, you’re missing out on serious money.

BNPL Season Success: Total BNPL spending reached a new peak of $18.2 billion during the 2024 holiday season, up 9.6% from 2023, with mobile devices accounting for 79.12% of these transactions.

AI’s Revenue Impact: AI and human agents influenced $229 billion of global online sales during the holiday season, with 19% of all holiday purchases influenced by consumers engaging with AI and agents – a 6% increase from 2023.

Social Commerce Growth: Retailers implementing social commerce strategies saw 20% of their global holiday sales generated through platforms such as TikTok Shop and Instagram.

🎯 Black Friday email campaigns need verified contacts

[Get Started →]

Extended Shopping Period: The trend of retailers launching sales earlier in November, or even October, points towards an “extended peak season” rather than a single-day event. This “holiday creep” means sustained campaigns over weeks, not days.

Global Projections: Looking at 2025, global e-commerce sales are projected to reach $6.86 trillion, with US e-commerce sales anticipated to hit $1.29 trillion. The growth trajectory shows no signs of slowing.

Technology Adoption Acceleration: Retailers using chatbot tools on Black Friday observed a 15% higher conversion rate compared to those who did not. Technology isn’t just nice-to-have anymore – it’s a competitive requirement.

The holiday shopping data makes one thing clear: businesses that can handle sustained, high-volume campaigns across multiple channels and payment methods will capture the biggest share of this massive market.

What This Means for Business Owners

These Black Friday statistics aren’t just interesting numbers – they’re a roadmap for where retail is heading and how smart business owners should prepare. Here’s what you need to focus on:

Mobile-First Is Non-Negotiable: With 69% of global purchases happening on mobile devices, your mobile experience needs to be flawless. If customers can’t easily browse, compare, and buy on their phones, you’re losing money every second.

Payment Flexibility Drives Sales: BNPL’s $686.3 million contribution and 8.8% growth shows that payment options directly impact conversion rates. Offering multiple ways to pay isn’t just customer service – it’s revenue optimization.

AI Is Your Competitive Edge: The 1,800% increase in AI-driven traffic and 15% higher conversion rates for retailers using chatbots prove that AI implementation is becoming essential, not optional.

Start Early, Plan Long-Term: The shift toward extended shopping seasons means your Black Friday strategy should really be a “Black November” approach. Early promotions consistently outperform last-minute campaigns.

Trust Builds Revenue: With 16% of shoppers skeptical about Black Friday offers, transparent pricing and honest communication become competitive advantages. Building trust pays dividends in customer loyalty.

Global Opportunities Abound: International markets showing 122-125% increases suggest that geographic expansion could be your next big growth lever.

Build Better Campaigns

Target Black Friday audiences with precision email tools

[Try Now →]

Investment Priorities for 2025: Based on this data, smart business owners should focus their resources on mobile optimization, AI integration, flexible payment systems, and building campaigns that run throughout November rather than just Black Friday weekend.

The businesses that will dominate Black Friday 2025 are those that start preparing now, invest in the right technology, and understand that modern consumers expect seamless experiences across all channels and payment methods.

FAQ

How much was spent on Black Friday 2024

What percentage of Black Friday shopping is online vs in-store?

How has mobile shopping changed Black Friday?

What are Black Friday 2025 predictions?

Find Quality Leads in Just One Click

Install SalesSo’s Chrome Extension and start collecting leads while you browse your favorite sites

Table of Contents

Conclusion

Black Friday 2024 proved that digital commerce isn’t just growing – it’s absolutely dominating the retail landscape. The $10.8 billion in US online sales and $74.4 billion globally represent more than impressive numbers; they signal a fundamental shift in how people shop and where businesses need to focus their efforts.

The data tells a clear story: mobile-first experiences, flexible payment options like BNPL, AI-powered customer service, and extended promotional periods aren’t trends anymore – they’re requirements for success. The businesses that embraced these strategies in 2024 saw remarkable results, while those that didn’t got left behind.

Looking ahead to Black Friday 2025, the opportunities are massive. With global e-commerce projected to hit $6.86 trillion and mobile commerce continuing its upward trajectory, early preparation and smart technology investments will separate the winners from the also-rans.

Whether you’re planning your first Black Friday campaign or optimizing an existing strategy, these statistics provide the roadmap. The question isn’t whether you should adapt to these trends – it’s how quickly you can implement them to capture your share of next year’s record-breaking sales figures.

Start preparing now, and Black Friday 2025 could be your biggest revenue day ever.

Find Quality Leads in Just One Click

Install SalesSo’s Chrome Extension and start collecting leads while you browse your favorite sites