LinkedIn Singapore Statistics: The Complete 2026 Data Guide

- Sophie Ricci

- Views : 28,543

Table of Contents

LinkedIn Singapore statistics

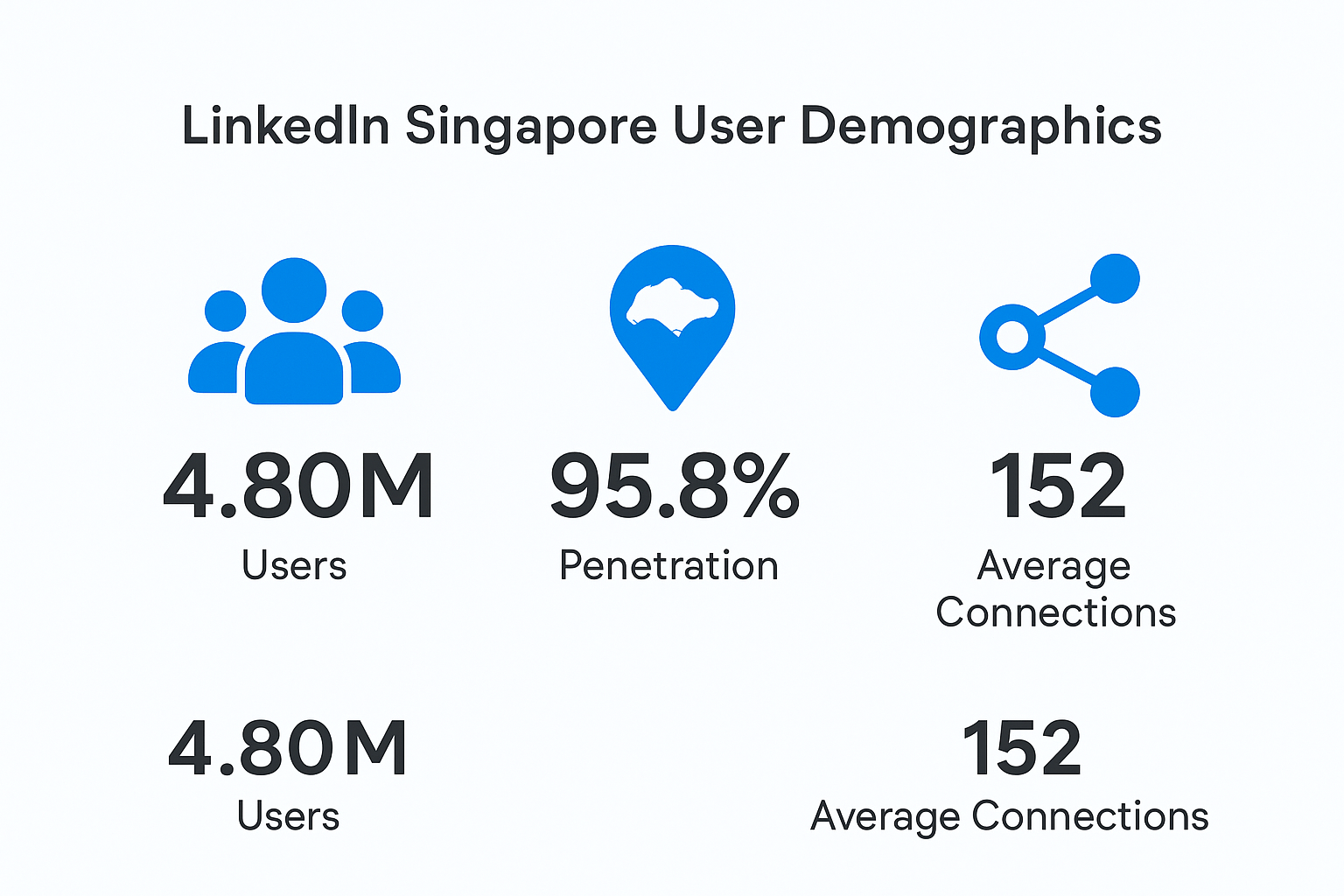

- 4.80 million LinkedIn members in Singapore as of January 2025 – with total population of 5.85 million, showing massive professional platform adoption

- 95.8% penetration rate among eligible adults (18+) – near-universal presence meaning professionals not on LinkedIn essentially don’t exist in modern business ecosystem

- Gender distribution: 52.8% male, 47.2% female – remarkable balance reflecting Singapore’s integrated workforce, particularly in PMET category

- 25-34 age group dominates at 45.7% of users – VPs, Directors, and Heads of Department with both authority and budget allocation power

- 35-54 age bracket represents 27.0% of users – C-suite and strategic decision-makers holding the budget keys

- Ranks 3rd globally in average connections per user with 152 connections – only UAE and Netherlands have more interconnected users, creating dense “small world” network

- Mobile connections: 10.5 million (179% of population) – average professional juggling multiple devices (work phone, personal phone, tablet)

- 97% of social media access happens via mobile devices – requiring mobile-optimized subject lines and value propositions visible without scrolling

- MRT commute windows 8-9 AM and 6-7 PM are golden engagement times – millions scrolling through notifications during subway rides

- Sales Development Representative, Cloud Engineer, and Enterprise Account Executive are fastest growing roles – companies aggressively scaling go-to-market functions

- Sustainability Consultant roles grew 62% – driven by Singapore’s “Green Plan 2030” and genuine regulatory pressure

- AI Researchers demand increased 81% – AI boom in Singapore isn’t hype, companies actively hiring to build capabilities

- Average SSI score: 40-50, top 1% performers: 75+ – algorithmic advantage matters when 95% of competitors are on platform

- Document posts (PDF carousels): 6.10% average engagement rate – highest of any format because Singaporeans value immediate, practical utility

- Video posts: 5.60% engagement rate – trend favors authentic “lo-fi” videos with direct-to-camera market observations over high production value

LinkedIn Singapore Statistics: The Complete 2026 Data Guide

Introduction

If you’re trying to reach decision-makers in Singapore, here’s something you need to know: LinkedIn isn’t just popular here—it’s basically universal.

With 4.80 million registered members and a staggering 95.8% penetration rate among adults, LinkedIn has become the digital backbone of professional networking in the Lion City. Whether you’re hiring talent, generating leads, or building your professional brand, understanding these numbers gives you a massive edge.

But raw numbers only tell half the story. The real question is: how do Singaporeans actually use LinkedIn, and what does that mean for your business?

This guide breaks down the latest LinkedIn Singapore statistics with context you can actually use. We’ll cover user demographics, hiring trends, engagement patterns, and the tools that make prospecting easier—all backed by 2025 data.

Let’s dive in.

LinkedIn Singapore Statistics: The Big Picture

Singapore punches well above its weight when it comes to LinkedIn adoption. Here’s what makes this market unique:

Total User Base and Penetration

LinkedIn Singapore has 4.80 million members as of January 2025. To put that in perspective, Singapore’s total population is only 5.85 million people.

When you adjust for age restrictions (LinkedIn is 18+), the platform reaches 95.8% of all eligible adults in the country. This isn’t just high adoption—it’s near-universal presence.

What this means for you: If you’re targeting professionals in Singapore and they’re not on LinkedIn, they essentially don’t exist in the modern business ecosystem. Identity resolution becomes dramatically easier here than in markets where professional networking is fragmented across multiple platforms.

🚀 Access 95% of Singapore’s Professionals

We help you reach decision-makers in this saturated market with precision targeting and proven campaigns.

Gender Distribution

LinkedIn Singapore shows remarkable balance:

- 52.8% male users

- 47.2% female users

This near-equal split reflects Singapore’s highly integrated workforce, particularly in the PMET (Professionals, Managers, Executives, and Technicians) category. Female labor force participation is strong, which means decision-making units are genuinely diverse.

Pro tip: Keep your messaging gender-neutral. Half your audience will appreciate it, and the other half won’t even notice—but get it wrong, and you’ll alienate a significant portion of your market.

Age Breakdown: Where the Power Sits

Understanding age distribution tells you who holds the budget keys:

- 18-24 years: 24.9% (junior staff, future workforce)

- 25-34 years: 45.7% (middle management, the execution engine)

- 35-54 years: 27.0% (C-suite, strategic decision-makers)

- 55+ years: 2.3% (senior advisors, board members)

The 25-34 age group dominates at 45.7%. These are your VPs, Directors, and Heads of Department—people with both authority and budget allocation power.

This generation grew up online. They value speed over formality, authenticity over polish, and social proof over sales pitches. If your outreach feels like a template, it gets deleted. If it shows you’ve done your homework, you get a meeting.

The Connectivity Factor

Here’s where Singapore gets interesting: it ranks 3rd globally in average connections per user, with 152 connections per person.

Only the UAE and the Netherlands have more interconnected users. This is higher than the UK (144 connections) and tech-forward nations like Denmark (143).

Why this matters: Singapore operates as a “small world” network. The degrees of separation between you and your target prospect are fewer than in larger markets. A mutual connection introduction isn’t just helpful—it’s often your best opening move.

The flip side? Reputation travels fast. Burn a bridge with spammy outreach, and word spreads quickly through those dense networks.

📊 Navigate Singapore’s Dense Network Successfully

Our targeting framework finds your ideal prospects while protecting your reputation in this interconnected market.

Digital Connectivity: The Foundation

To understand LinkedIn’s role, you need context on Singapore’s broader digital landscape. This is one of the most connected populations on Earth.

Mobile and Internet Penetration

- Mobile connections: 10.5 million (179% of population)

- Internet users: 5.61 million (95.8% penetration)

- Social media users: 5.16 million (88.2% of population)

That 179% mobile penetration means the average professional is juggling multiple devices—work phone, personal phone, potentially a tablet. Your prospect isn’t just distracted; they’re operating across multiple screens simultaneously.

Internet penetration at 95.8% represents saturation. Being offline in Singapore isn’t a lifestyle choice—it’s a temporary technical error.

Mobile-First Reality

Here’s the number that should change how you write every message: 97% of social media access in Singapore happens via mobile devices.

Think about what this means for your cold email or InMail. If it looks like a wall of text on an iPhone screen, it gets deleted before the second paragraph.

The commute factor: Millions of professionals ride the MRT (Singapore’s subway system) during 8-9 AM and 6-7 PM. They’re on their phones, scrolling through notifications. This is your golden window for engagement.

Your subject line needs to fit on a mobile notification. Your value proposition needs to be visible without scrolling. If you’re not optimizing for mobile, you’re not optimizing for Singapore.

Hiring Trends and Jobs Data

If you want to know where the budget is flowing, follow the hiring trends. LinkedIn’s “Jobs on the Rise” data for Singapore in 2025 reveals some clear winners:

Fastest Growing Roles

- Sales Development Representative

- Cloud Engineer

- Enterprise Account Executive

- Healthcare Assistant

- Cyber Security Engineer

The fact that sales roles dominate the top three is a flashing signal. Singaporean companies are aggressively scaling their go-to-market functions. They’re building teams, which means they need tools, training, and infrastructure.

Cloud Engineers and Cyber Security Engineers growing fast tells you companies are modernizing their tech stacks and taking security seriously. If you sell DevOps tools, cloud optimization, or security compliance software, your trigger event is the hiring of these roles.

Industry-Specific Growth

Beyond job titles, broader trends reveal where momentum is building:

Green Economy: Roles like Sustainability Consultant grew by over 62%. This isn’t just PR—it’s driven by Singapore’s “Green Plan 2030” and genuine regulatory pressure.

AI & Technology: Demand for Artificial Intelligence Researchers increased by 81%, with AI Engineers following closely. The AI boom in Singapore isn’t hype—companies are actively hiring to build these capabilities.

Hospitality Recovery: Food and Beverage Assistants saw 92% growth, reflecting Singapore’s post-pandemic tourism rebound.

What to sell based on hiring:

- Companies hiring SDRs need CRM tools, data enrichment, and sales coaching

- Companies hiring Cloud Engineers need DevOps platforms and optimization services

- Companies hiring Sustainability Consultants need ESG reporting software and compliance tools

- Companies hiring AI Engineers often have budget for complementary software and data infrastructure

💼 Target Companies During Growth Windows

Our campaign design identifies hiring signals and reaches decision-makers when budgets are approved and teams are scaling.

Social Selling: Making LinkedIn Work for You

Knowing the market is one thing. Getting seen by the right people is another. This is where understanding LinkedIn’s algorithm and engagement patterns becomes critical.

The Social Selling Index (SSI)

LinkedIn assigns every user a score from 0 to 100 measuring effectiveness across four pillars: Brand, People, Insights, and Relationships.

In Singapore:

- Average user: 40-50 SSI score

- Top 1% performers: 75+ SSI score

This isn’t just a vanity metric. LinkedIn’s algorithm prioritizes content and outreach from high-SSI accounts. A score of 75 versus 45 is the difference between appearing on Page 1 or Page 10 of search results.

In a market where 95% of your competitors are on the platform, algorithmic advantage matters.

Content That Actually Gets Engagement

Singapore professionals are selective about what they engage with. Here’s what works in 2025:

Document posts (PDF carousels): Average engagement rate of 6.10%—the highest of any format. Why? Singaporeans value utility. A downloadable PDF titled “5 Steps to Navigate MAS Regulations” offers immediate, practical value.

Video posts: Close behind at 5.60% engagement. But don’t overthink production value. The trend favors authentic, “lo-fi” videos where someone speaks directly to camera about market observations.

Meaningful comments: The algorithm rewards comments over 15 words. Adding a thoughtful paragraph to a prospect’s post often outperforms a cold InMail—you demonstrate expertise publicly while building familiarity.

The Job Posting Intelligence Play

When a target account posts a job opening, don’t scroll past. This is actionable intelligence:

- They have budget (they’re hiring)

- They have a gap (current team can’t handle the load)

- Decision-makers are accessible (hiring managers are often listed)

Comment on the job post to increase visibility. Message the hiring manager with a perspective, not a pitch: “Saw you’re hiring a Head of Sales. While you search, how are you managing current lead flow?”

This triangulation uses LinkedIn statistics jobs data to fuel your outreach while boosting your visibility on the platform.

Data Quality and Tools: Building Your Tech Stack

In the US, you might buy one tool and be 90% covered. Singapore is more complex. APAC data quality varies significantly across platforms.

The Lead Enrichment Landscape

Apollo.io offers 275 million contacts with built-in sequencing. It’s cost-effective and popular with startups. The challenge: it relies heavily on community-contributed data, which can decay quickly in dynamic markets like Singapore with high job turnover.

ZoomInfo provides enterprise-grade firmographics with excellent US coverage. However, APAC mobile number coverage can be inconsistent, and it typically requires a “global” add-on at significant cost.

Cognism positions specifically on GDPR and DNC (Do Not Call) compliance, with claims of higher accuracy for mobile numbers in APAC. For teams calling Singaporean prospects, avoiding the DNC registry is critical.

The Waterfall Strategy

Single-source data in APAC typically yields 50-60% match rates. To reach the 85-95% accuracy needed for effective outreach, use a waterfall approach:

- Start with your primary tool (Apollo, for example)

- If no email found, cascade to a secondary source (ZoomInfo)

- If no mobile found, cascade to a third option (Cognism or local provider)

This layered approach maximizes coverage without breaking the budget.

For teams needing a cost-effective starting point: Tools like Salesso offer comprehensive cold email infrastructure including email verification, warming, and automation—positioning alongside platforms like Saleshandy for teams prioritizing email outreach over multi-channel approaches.

⚡ Skip Data Tools, Book Meetings

We handle targeting and enrichment. You focus on closing deals from qualified Singapore decision-makers.

7-day Free Trial |No Credit Card Needed.

Privacy, Compliance, and Legal Boundaries

Singapore is a rule-of-law society. The “move fast and break things” mentality doesn’t apply to data privacy here.

The Personal Data Protection Act (PDPA)

Singapore’s PDPA framework is strict:

Do Not Call (DNC) Registry: You cannot cold call numbers on the DNC list without clear consent or an existing relationship. B2B calls have some exemptions, but the line blurs as more professionals use personal mobiles for work.

Consent requirements: You generally need consent to collect, use, or disclose personal data. However, there’s a “Business Asset” exception—if you find a business email publicly listed on a company website, you can likely use it for relevant B2B outreach.

Where it gets risky: Automated scraping using bots falls into gray areas that can quickly become violations.

LinkedIn’s User Agreement and Privacy Policy

Pay close attention to the agreement privacy terms when using LinkedIn and third-party tools.

The Mantheos precedent: LinkedIn successfully sued Singapore-based company Mantheos for unauthorized data scraping. Mantheos was forced to delete all scraped data and destroy its software.

The lesson: LinkedIn watches Singapore closely. Browser extensions that aggressively scrape profiles (viewing 1,000 profiles per day) risk permanent account bans. The User Agreement explicitly prohibits “bots, crawlers, or other automated methods.”

Recent AI training update: In late 2024, LinkedIn updated its privacy policy to allow user data to train generative AI. This sparked backlash among privacy-conscious Singaporean users. If you’re using AI to write outreach messages, ensure you’re not feeding sensitive prospect data into public LLMs—this could violate your company’s NDAs or your own policy cookie agreements.

Third-Party Tool Risk

When evaluating cheaper lead gen tools, review their cookie policy and data handling practices. If they’re selling your usage data to third parties, you might inadvertently violate your company’s security protocols.

In Singapore, where supply chain security is top-of-mind for CISOs, using a non-compliant tool makes you a liability rather than an asset.

Practical Strategies for Singapore Outreach

Theory matters, but execution wins deals. Here’s how to structure outreach that actually converts in Singapore.

Tone and Messaging

Be direct. Singaporeans value efficiency. Skip the “I hope this email finds you well in these uncertain times” opener—it’s 10 words too long.

Lead with credibility. Drop local references: “We work with DBS,” “We helped Singtel scale,” “We’re integrated with GovTech systems.” Local social proof carries more weight than global brand names.

Match the generation. The dominant 25-34 age group prefers peer-to-peer communication over formal vendor-customer dynamics. They value authenticity and can spot AI-generated templates instantly.

The Multi-Channel Sequence

Single-channel outreach is a dead end in 2025. Layer your approach across 14 days:

Day 1 – LinkedIn Connection Request: No pitch. Context hook only. “Hi [Name], noticed your post about the new MAS regulations. We’re navigating similar challenges. Would value connecting.”

Day 3 – LinkedIn Engagement: Comment meaningfully on their recent post (15+ words for algorithmic weight).

Day 6 – Email with Value: “Hi [Name], saw you’re scaling your sales team based on recent LinkedIn job posts. Onboarding is typically the bottleneck in Singapore. Here’s a brief guide on how [Local Company] reduced ramp time by 40%.”

Day 9 – LinkedIn InMail: “Sent you an email about sales onboarding efficiency. Worth a quick chat, or should I connect with [Colleague Name]?”

Day 14 – The Respectful Exit: “Guessing this isn’t a priority right now. I’ll keep an eye on your updates. Best of luck with the hiring.”

Timing Your Outreach

Execute during commute windows when mobile usage peaks: 8-9 AM and 6-7 PM Singapore Time (SGT), focusing on Tuesday through Thursday.

If you send your email at 3 AM Singapore time (because it’s your afternoon in New York), it gets buried by morning. Use scheduling tools to hit inboxes exactly when prospects are scrolling during their MRT commute.

Conclusion

Singapore’s LinkedIn ecosystem in 2025 isn’t just another market—it’s one of the most saturated, sophisticated, and opportunity-rich professional networks in the world.

With 4.80 million members, 95.8% adult penetration, and 179% mobile connectivity, you’re operating in a environment where everyone is reachable, but attention is the scarcest resource.

The opportunity is real: companies are hiring aggressively (especially in sales and tech roles), professional networks are dense and active, and B2B decision-makers are genuinely engaged on the platform.

But the margin for error is razor-thin. The days of scraping data and blasting generic templates ended with the Mantheos lawsuit and PDPA enforcement. Privacy-conscious buyers, algorithmic gatekeeping, and a small-world network where reputation travels instantly mean you need precision over volume.

Your three pillars for success:

- Data integrity: Validate every contact through compliant, multi-source verification

- Social authority: Treat your SSI score like a credit score—nurture it daily through authentic engagement

- Contextual relevance: Every message must answer “Why me? Why now? Why Singapore?”

Stop treating Singapore like another CSV file to blast. Treat it like the elite networking environment it is. The professionals here are sophisticated, connected, and willing to engage—if you approach with respect, relevance, and real value.

Master these LinkedIn Singapore statistics, understand the behavioral patterns behind the numbers, and you’ll build the pipeline you need.

FAQs

What is considered a good LinkedIn SSI score in Singapore?

How many LinkedIn users are in Singapore in 2025?

Is it legal to scrape LinkedIn profiles in Singapore for prospecting?

What are the best times to reach decision-makers on LinkedIn in Singapore?

Which industries are hiring most actively on LinkedIn Singapore?

- blog

- Statistics

- LinkedIn Singapore Statistics 2026: User Data & Trends